Giggle Finance is a fintech company that specializes in providing loans to gig entrepreneurs and small business owners. Their unique approach to lending, which does not require a traditional credit check, makes them a favorite for independents, freelancers, and others involved in the gig economy however few other lenders offer similar services for the needs of gig workers. This article explores some of Giggle Finance’s best options, their unique features, and how they meet the needs of gig workers.

LendUp As A Loan Like Giggle Finance

LendUp offers personal loans up to $1,000 with a maturity period of 30 days. It is designed for borrowers with poor credit scores and promises faster approval. High interest rates may be a problem, but LendUp focuses on financial education and credit-building tools, making it a viable option for those looking to improve their credit with short-term cash flow on.

Key Features

- Loan Amount: Up to $1,000

- Repayment Terms: Up to 30 days

- Interest Rates: Higher than average

- Target Audience: Borrowers with poor credit

OppLoans

OppLoans offers personal loans up to $4,000 with extended flexible repayment terms up to 36 months.This platform also caters to poor borrowers and promises faster approvals. OppLoans stands out by their focus on credit building, with payments reported on time to the major credit bureaus.

Key Features

- Loan Amount: Up to $4,000

- Repayment Terms: Up to 36 months

- Interest Rates: High

- Credit Reporting: Yes

- Target Audience: Borrowers with poor credit

Ualett

Ualett is a cash advance application designed specifically for rideshare delivery drivers. It offers future income growth, and disburses funds within 24 business hours after approval. This service is ideal for gig entrepreneurs who need to earn money quickly based on expected earnings.

Key Features

- Service Type: Cash advances

- Approval Time: 24 business hours

- Target Audience: Rideshare and delivery drivers

Installment Loans Like Giggle Finance

Many platforms offer customized loans for gig workers and self-employed entrepreneurs, such as Giggle Finance. These loans typically come with flexible terms and are tailored to fit the specific financial circumstances of gig economy workers.

Popular Platforms

- Lean: Offers early wage access and cash advances based on earnings.

- Moves: Provides low-interest loans without hard credit checks.

- Stoovo: Uses an AI-driven assistant to optimize gig work opportunities and provide flexible loans.

- Coverr: Offers cash advances up to $5,000 for gig workers.

- Belay: A digital bank with features like automatic tax withholding and expense management.

Key Features

- Lean: Early wage access, gig work optimization

- Moves: Low-interest loans, no hard credit checks

- Stoovo: AI-driven personal assistant, flexible loans

- Coverr: Simple application process, cash advances up to $5,000

- Belay: Tax withholding, expense management

Loans Like Giggle Finance With No Credit Check To Major Bureaus

For those who don’t want their credit checked by the big companies, many lenders offer loans without this requirement. These options can be useful for borrowers who don’t have bad credit or want to avoid tough questions.

Options

- OppLoans: Up to $4,000 with flexible repayment terms.

- Avant: Up to $35,000, targeting borrowers with poor to fair credit scores.

Key Features

- No credit check required

- Flexible repayment terms

- Higher interest rates

Payday Loans Like Giggle Finance

Payday loans are short-term loans designed to provide quick cash advances. Many platforms offer payday loans similar to Giggle Finance, each with unique features and terms.

Popular Platforms

- MoneyLion: Up to $250 with no interest or fees.

- Dave: Up to $100 with no fees, plus budgeting tools.

- EarnIn: Access to earned income early, up to $100 per day.

- MoneyMutual: Connects borrowers with payday loan lenders.

- Albert: Up to $100 with budgeting and savings tools.

- Brigit: Up to $250 with overdraft protection.

- Chime SpotMe: Fee-free overdraft protection up to $200.

- Cleo: Up to $100 with budgeting and savings features.

Key Features

- MoneyLion: Personal loans, debit card

- Dave: Budgeting tool

- EarnIn: No fees or interest

- MoneyMutual: Loan connection service

- Albert: Budgeting, savings tools

- Brigit: Overdraft protection

- Chime SpotMe: Fee-free overdraft protection

- Cleo: Budgeting, savings tools

Cash Advance for Gig Workers, No Credit Check

The move offers interest-free advances of up to $1,500 for gig workers without the need for a credit check. This can be crucial for gig workers who need financial stability without impacting their credit scores.

Key Features

- No credit check required

- Interest-free cash advances

- Up to $1,500

Coverr Loans As A Loan Like Giggle Finance

Coverr Loans caters to small business owners and gig workers who earn 1099 income, offering loans up to $5,000. The application process is straightforward, with approvals taking up to 24 hours, and funds are generally reserved by the next business day.

Key Features

- Loan Amount: Up to $5,000

- Application Process: Online

- Approval Time: Up to 24 hours

- Repayment: Based on revenue

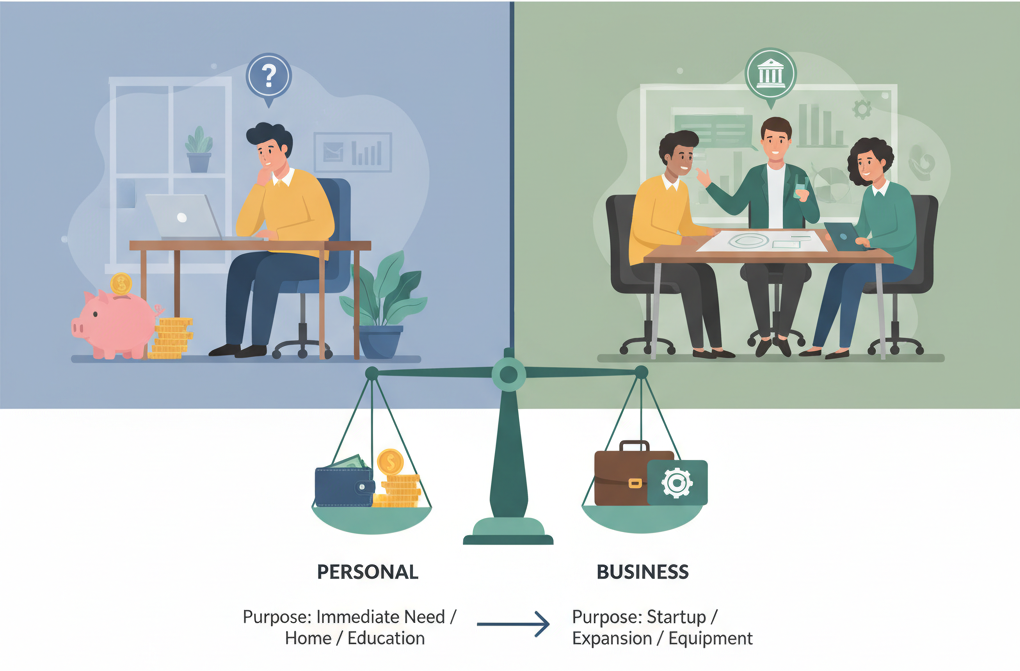

Other Types Of Loans And Lines Of Credit Like Giggle Finance

Installment Loans for Gig Workers

Term loans are available to gig workers who need cash for capital expenses. These loans are repaid over a set period of time, making them suitable for debt consolidation, home renovations or major purchases.

Instant Line of Credit for Gig Workers

Giggle Finance offers instant loans, giving gig workers access to the cash they need. Interest is paid only on the loan amount, making it affordable.

Loans for Gig Workers with Bad Credit

OppLoans and similar lenders offer loans to gig workers badly, focusing on simple eligibility requirements and fast approval processes.

Cash Advance for DoorDash Drivers

Ualett offers priority financing specifically for ride-sharing drivers and delivery services, with financing issued within 24 hours of approval. This service is ideal for covering unexpected expenses or making up differences between paychecks.

Does Giggle Finance Report to Credit Bureaus?

Giggle Finance reports payments to Experian and TransUnion, helping borrowers improve their credit scores by making payments on time. This report can be useful for building or rebuilding credit over the long term.

Credit Bureau Reporting

- Experian: Yes

- TransUnion: Yes

- Equifax: No

Giggle Finance Interest Rate

Giggle Finance uses factor rates instead of traditional interest rates, which typically range from 1.15 to 1.7. Additionally, the 7% loan origination fee is charged. Understanding the total payments affected by factor rates is necessary to analyze the cost of borrowing.

Example

- Loan Amount: $5,000

- Factor Rate: 1.15 to 1.7

- Total Repayment: $5,750 to $8,500

Many platforms offer similar services with unique features and flexible terms for gig entrepreneurs and small business owners looking for an alternative to Giggle Finance Whether you need cash advances, loans offered at period, or the loan method, exploring these options can help you determine which one best suits your financial needs. Each platform has its own strengths, from fast approval times to no-screening loans, credit-building tools and interest-free financing, making it easier for gig workers to manage their finances.