In a digital lending-first world, knowing the difference between pre-approved loans and pre-qualified loans is more than spelling money-terms right: it is about smarter decisions for your finances, your business, and your app users. Pre-approval or pre-qualification, we will help you understand the differences. You are a borrower, developer of a fintech service, or have a fintech marketing company; knowing the difference can help you prevent unnecessary rejections, achieve faster conversions, and prevent negative effects to your credit score.

Why This Distinction Matters More Than Ever

With AI-driven underwriting, open banking, and instant API integrations, lenders now classify customers into precise categories. But that also means loan offers can feel more complex. Many still confuse “pre-approved” with “pre-qualified,” even though the implications are vastly different.

Inaccurate assumptions about either could lead to:

- Unwanted credit score drops

- Rejected applications

- Missed loan opportunities

- Poor user experience on financial platforms

Understanding this difference—and the loan terminology ex that goes with it—is essential in fast-evolving financial space.

What Is a Pre-Qualified Loan?

A pre-qualified loan is a general estimate based on information you self-reported and a soft credit inquiry, which does not affect your credit score.

Key features:

- Show inquiry: your lender will check the basics of your credit without impacting your score.

- Self-reported data: You provided things such as income, employment, and obligations.

- Quick estimate: Your lender will provide a possible amount for a loan or range.

- No documentation required initially

- No-binding offer: This is not a deal, just a preliminary screening.

Example: you might go to a lending website, fill in the monthly income and the basic information, and instantly receive a message that you are pre-qualified for a $5,000 personal loan. In reality, this is just a broad estimate.

What Is a Pre-Approved Loan in?

A pre-approved loan is a more formal offer based on verified data and usually requires a hard credit inquiry, which can slightly impact your credit score.

Key Features:

- Hard Credit Pull: Full credit history is assessed

- Income and ID Verification Required

- Specific Terms Provided: Interest rate, loan amount, and tenure are defined

- Stronger Commitment from Lender

- Valid for a Limited Time: Often expires within 15–30 days

Example: Your bank sends you a pre-approved loan offer for $10,000 at a 9% interest rate. You accept it, upload your documents, and the loan is processed within hours.

Pre-Approved vs Pre-Qualified Loans: Key Differences

Here’s a concise breakdown of how these terms differ using modern loan terminology ex:

| Criteria | Pre-Qualified | Pre-Approved |

| Credit Check | Soft pull (no impact) | Hard pull (affects score) |

| Data Source | Self-reported | Verified documents |

| Offer Type | Estimate | Confirmed offer |

| Documentation | Not required upfront | Required |

| Accuracy | Low to Medium | High |

| Best For | Research stage | Ready-to-borrow stage |

The Role of Loan Terminology Ex in Lending

Consumers and developers must understand modern loan terminology ex to navigate offers and avoid confusion.

Essential Terms to Know:

- APR (Annual Percentage Rate): Includes interest + fees

- LTV (Loan-to-Value): Compares loan amount to asset value (e.g., in home loans)

- DTI (Debt-to-Income Ratio): Percentage of your income used for debt payments

- EMI (Equated Monthly Installment): Fixed payment each month

- Tenure: Duration of loan repayment

These terms often appear in both pre-qualification and pre-approval communications. Misunderstanding them could lead to wrong choices or rejected applications.

How Fintech Platforms Are Using These Terms

Fintech lenders like Capitalix, FXRoad, and TradeEU Global are leveraging AI, behavioral analytics, and embedded finance models to offer tailored pre-qualified or pre-approved loans.

Use Cases:

- AI-Based Pre-Qualification: Apps evaluate your bank statements to suggest eligibility instantly

- In-App Pre-Approvals: Based on spending and repayment history, users get offers in-app without applying

- Real-Time API Integration: APIs allow apps to generate live loan offers based on user behavior

By understanding pre-approved vs pre-qualified loans, platforms can enhance UX and increase conversion rates—without misleading users.

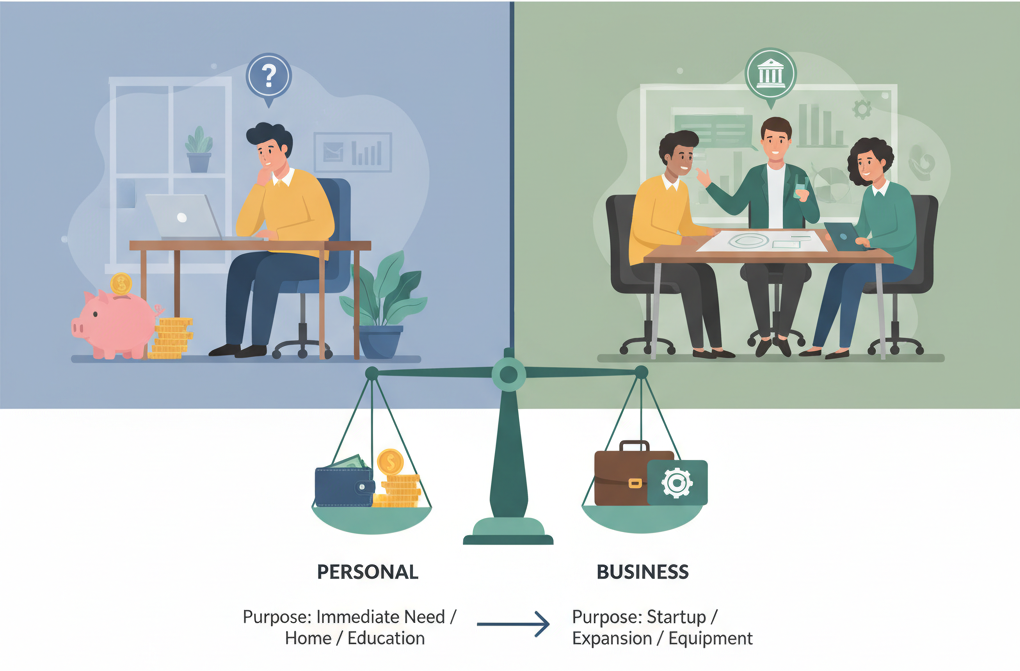

When Should You Opt for Pre-Qualification?

Choose pre-qualification when:

- You’re comparing loan products across multiple platforms

- You’re unsure about your credit profile

- You want to avoid a hard inquiry

- You’re in early stages of financial planning

- You prefer minimal documentation

It’s also ideal for developers looking to integrate a low-friction lead generation tool into fintech apps.

When Should You Choose Pre-Approval?

Go for pre-approval when:

- You’re ready to borrow immediately

- You want specific terms like interest rate and loan amount

- You’re applying for high-value loans (mortgage, auto, business)

- Your credit profile is strong

- You’re willing to submit verification documents

Marketers often promote pre-approvals as “exclusive” or “limited time” offers, boosting urgency and conversions.

Common Mistakes to Avoid

Avoid these missteps when navigating pre-approved vs pre-qualified loans:

- Assuming pre-qualification means guaranteed approval

- Applying to multiple lenders and triggering several hard inquiries

- Not reading the fine print in the offer letter

- Misunderstanding key loan terminology ex like APR or EMI

- Rushing into pre-approval without preparing documentation

Being informed prevents poor credit decisions and improves financial confidence.

Developer and Marketer Insights: Using These Terms Right

For app developers and financial marketers, clarity in UX and messaging is vital. Here’s how to implement these loan types effectively:

Developer Tips:

- Add loan terminology ex tooltips to explain APR, DTI, etc.

- Label pre-qualification screens clearly to avoid confusion

- Use soft-check APIs for eligibility tools

Marketing Tips:

- Use pre-qualified offers as top-of-funnel tools

- Promote pre-approved offers with urgency

- Always disclose if a credit pull is soft or hard

- Educate users via onboarding flows and blog content

The Lending Landscape: More Real-Time, More Data-Driven

Thanks to fintech advances, pre-qualification and pre-approval processes are now:

- Faster: AI processes millions of data points in seconds

- Smarter: Offers are based on actual behavior, not just static scores

- More Secure: Open banking enables safe verification

- More Transparent: Regulators now demand accurate use of loan terminology ex

This means better loan experiences for everyone—as long as you know how to navigate them.

Final Summary: Make the Right Choice Based on Readiness

To recap the pre-approved vs pre-qualified loans comparison:

- Pre-Qualified = A soft, no-obligation estimate based on basic info

- Pre-Approved = A firm offer with verified data and a credit check

If you’re just exploring, start with pre-qualification. If you’re ready to move forward, aim for pre-approval.

And whether you’re a borrower or a builder of lending tools—always prioritize transparency, accuracy, and understanding the right loan terminology ex.

FAQs

How does a pre-approved loan differ from a pre-qualified one?

Pre-approved loans involve verified data and a hard credit check. Pre-qualified loans use self-reported info and soft credit pulls.

Why should I care about loan terminology ex?

Because it helps you understand your offer’s real value—knowing terms like APR, EMI, and DTI improves financial decisions.

Is pre-qualification completely risk-free?

Yes. It doesn’t affect your credit score and gives a general sense of what you might qualify for.

Can I be denied after pre-approval?

Yes, if your income or credit status changes, or you fail to submit required documentation, the lender can still reject the final application.

How do fintech apps use pre-approved vs pre-qualified offers?

Pre-qualified offers attract users without credit impact. Pre-approved offers drive conversions with real-time, personalized loan deals.