Understanding the APR (Annual Percentage Rate) is important when it comes to using a loan or credit card. Many people ask, “Does the APR matter if I pay on time?” The answer is yes, but the impact depends on the context. In this article, we’ll explore how APRs work, their impact on credit card debt, and when they’re used.

What is APR?

The APR represents the total cost of the loan, including interest and fees. It is expressed as an annuity, but can be spent on a monthly or daily basis depending on the lender. APRs range from about 10% to more than 30%, depending on the type of loan, the borrower and the borrower’s credit score. Understanding the APR is key to effectively managing costs and avoiding unnecessary expenses.

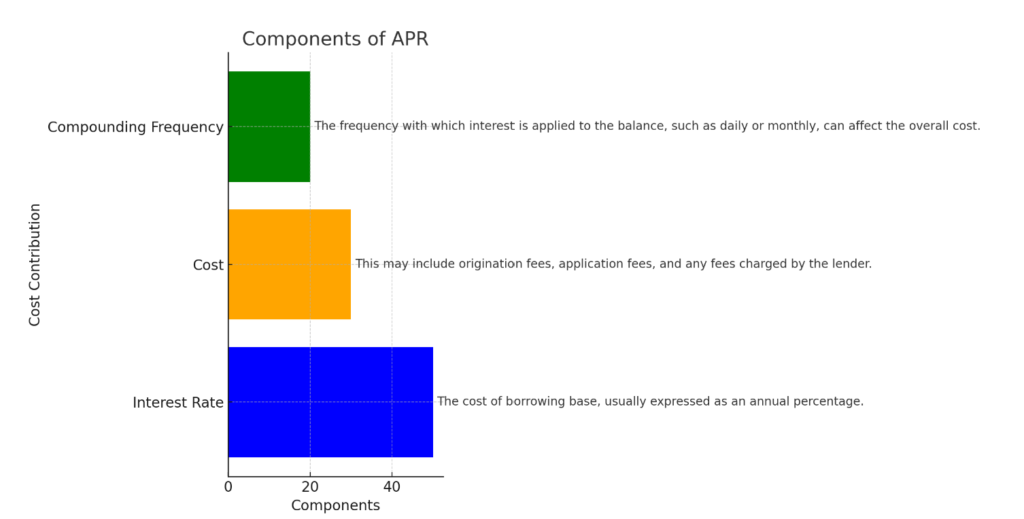

The Components of APR

The APR is not just the interest rate on loans or credit cards; Includes costs associated with debt. These may include:

- Interest Rate: The cost of borrowing base, usually expressed as an annual percentage.

- Cost: This may include origination fees, application fees, and any fees charged by the lender.

- Compounding Frequency – The frequency with which interest is applied to the balance, such as daily or monthly, can affect the overall cost.

How APR is Calculated

The calculation of APR can be complex, involving the compounding of interest and the inclusion of various fees. Here’s a simplified version:

For example, if you borrow $1,000 at an interest rate of 10% and pay $50 in fees over a one-year term, the APR calculation would look like this:

![]()

Does APR Apply If I Pay On Time?

Many people ask, “Does the APR apply if I pay on time?” The credit card APR will only apply if you don’t pay the balance in full each month. If you pay the balance in full, there is no interest, and the APR does not apply. However, if you carry a balance, the APR determines the interest rate you will be charged. Even if your payments are made on time, the APR can increase over time.

Example Scenario

Imagine you have a credit card with a 20% APR and $1,000 in debt. If you do not pay the balance in full by the due date, the APR will begin accruing on the unpaid amount. If you pay $500 by the due date and transfer more than $500, interest will be calculated on the remaining $500.

Do I Pay APR If I Pay On Time?

In a loan, the APR represents the total cost of the loan, including fees. Even if you get paid on time, a higher APR means you’ll pay more over the life of the loan. For example, a personal loan with a 20% APR will cost more than one with a 10% APR, even if you pay on time.

Does Credit Card APR Matter If You Pay On Time?

If you pay off your credit card in full each month, you are not directly affected by the APR. However, it’s still important to understand the APR, as it can change over time, and you may not always be able to afford it all. Additionally, some credit cards offer rewards or benefits related to the APR, so understanding how this works can help you maximize your returns.

Variable vs. Fixed APR

A credit card can have a variable or fixed APR. Variable APRs fluctuate with market interest rates, while fixed APRs remain constant. Even if you pay on time, knowing whether your APR fluctuates or is fixed is important, as changes in interest rates can affect your loan costs in the future.

Does APR Matter If You Pay In Full?

No. You do not pay the APR if you pay off your credit card in full each month. But as mentioned earlier, the APR can still affect you the wrong way, and understanding how it works can help you make informed financial decisions.

Grace Periods

Most credit cards offer a grace period, usually 21-25 days, where you can pay off the balance interest-free. Paying off your balance in full during this period means avoiding the APR altogether. But if you’re carrying a balance, the grace period doesn’t apply to further purchases, meaning you can accumulate interest immediately.

Do You Only Pay APR If You Miss A Payment?

No, if you miss a bill, you don’t just pay the APR. With credit cards, if you carry a balance, the APR applies even if you pay on time. With a loan, the APR is half of the total cost of the loan, regardless of the repayment term.

Penalty APR

Failure to pay can result in a penalty APR, which is a higher interest rate applied to your account. This rate can be significantly higher than your typical APR and can be applied for months or even forever depending on the credit card issuer’s policy. Always read the terms and conditions of your loan agreement to understand the consequences of default.

When Do You Pay APR?

The APR is paid on the credit card when you transfer the balance and not the full amount due. The APR is applied to the balance and interest is charged accordingly.

When Do You Pay APR On A Credit Card?

Try to pay more than the minimum monthly payment to reduce the impact of the APR on your credit card. This leads to a faster depreciation of the principal, thus lowering interest rates.

When Does The APR Apply?

The APR applies when you borrow or use a loan, and is generally stated in the loan or loan agreement. With credit cards, the APR applies when you carry the balance, and with loans, it’s part of the total cost of the loan.

Introductory APR Offers

Some credit cards offer introductory APRs, which are low rates for a specific period of time, usually 6 to 18 months.After the introductory period, the regular APR takes effect. These features can be useful for cash advances or large purchases, but it’s important to understand when the regular APR applies.

Is APR Bad?

APR is not inherently bad; It’s an important part of lending. However, high APRs can create a financial burden, so understanding how APRs work and choosing a loan at the right price is important.

Do You Have To Pay APR?

If you take out a loan or use a loan, you generally have to pay the APR unless you pay the balance on your credit card in full each month during the grace period. For loans, the APR is part of the total cost of the loan.

The Impact of Credit Scores on APR

Your credit score greatly affects the APR offered to you. Higher credit scores usually result in lower APRs, as lenders consider you less risky. Conversely, a low credit score can lead to higher APRs and more expensive loans.

Improving Your Credit Score

Improving your credit score can improve the APR offered. Some ways to boost your credit score include:

- Paying on time: Paying bills on time means that the lender is reliable.

- Debt reduction: Reducing your expenses and income can improve your credit score.

- Avoid applying for new loans: Asking too many loan inquiries in a short period of time can negatively affect your score.

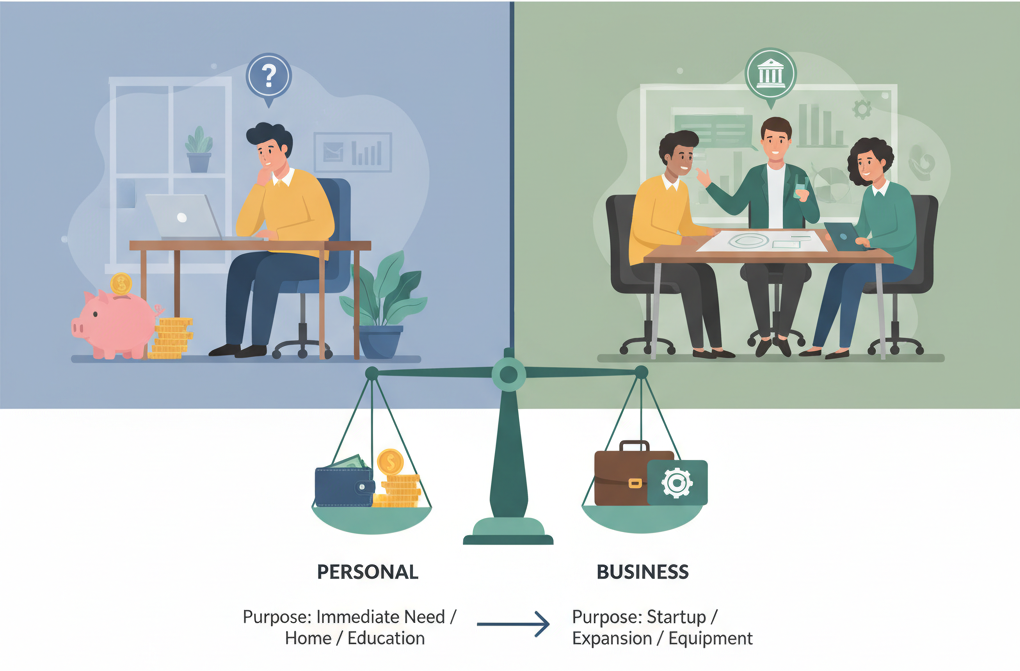

APR and Different Types of Credit

The APR applies differently to different types of debt, such as credit cards, personal loans, car loans, and mortgages. Understanding these differences is key to managing your finances effectively.

Credit Cards

As discussed, the APR on credit cards applies to cattle carriers. Some cards also have different APRs for purchases, transfers and advances. Know these differences to avoid unexpected expenses.

Personal Loans

The APR for personal loans includes interest and any associated fees. These loans usually have a fixed APR, making it easy to budget for monthly repayments. However, you still need to shop around to get the best price.

Auto Loans

Car loans often have a lower APR than credit cards and personal loans, especially if they are secured by a car. However, the overall cost of a loan can vary widely between lenders, so it’s important to compare the products they offer.

Mortgages

The loans usually have a lower APR than conventional loans, but they also have higher rates. Fixed-rate mortgages have constant APRs over the term of the loan, while adjustable-rate mortgages (ARMs) have variable rates.

Understanding APRs is essential to making informed financial decisions. Whether you use a credit card or take out a loan, knowing how the APR works and when it applies can help you better manage your finances. Always review loan agreements carefully, and don’t hesitate to ask questions if you’re unsure of the APR or other terms. By doing so, you can avoid unnecessary debt and make the most of credit opportunities.