Understandably, personal loans are a very important instrument in the content of many consumers because they may provide an answer for a range of financial goals together with securing, consolidating, investing, or protecting one’s cash. NetCredit is the company in this market offering personal loan products to people who cannot be considered creditworthy for one reason or another.

However, it is caused healthier to consider other possibilities so as to make certain that one is insuring at not steep price. In this article, the author endeavored to offer you more substantial substitutes of NetCredit and guide you to the appropriate personal loan.

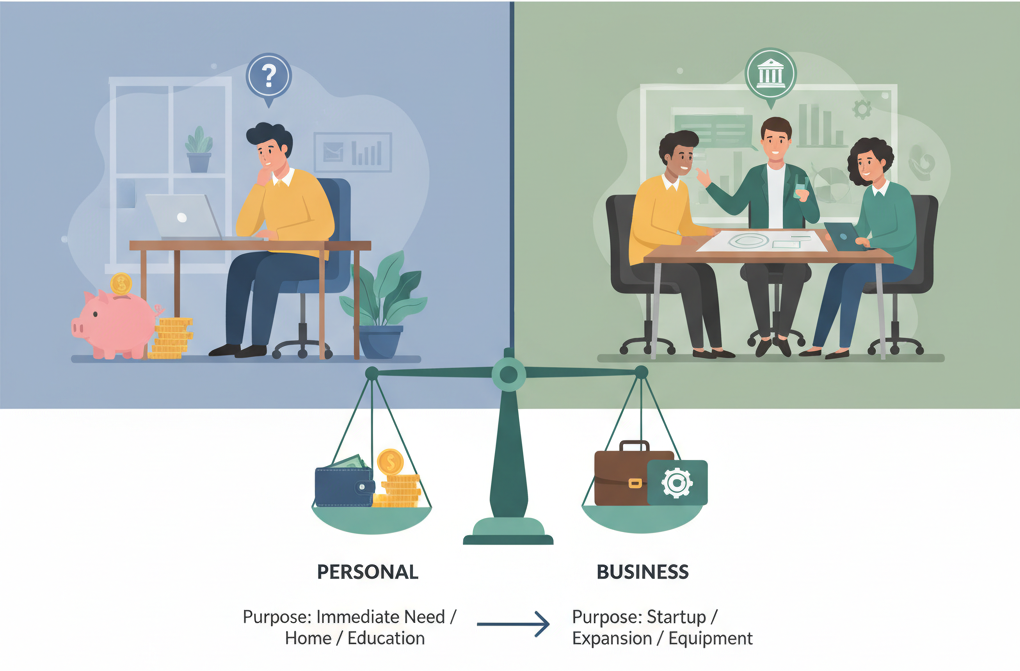

Understanding Personal Loans

Personal Loan falls under the installation loan where the loan can be used for any need; for example, grounds, debt settlement, or repairs. They come in two primary types: There are two types of loans; the secured loans which are loans that are offered after the provision of collateral and unsecured loans which are given out without collaterals.

Benefits:

- This translates to fixed interest rates and lieu monthly installments.

- Flexibility in usage

- The biggest advantage is that there can be lower interest charges than credit cards.

Risks:

- Just like people with a bad credit status, he will be charged high interest rates for Rep<Accounting seen from angle interest rates for those with poor credit.

- One of the potential risks of the augmented capital expenditure is that it could result in increased debt depending on proper management.

In choosing any personal loan company, some of the requirements that need to be checked are the interest rates to be charged, the loan tenure, the fees and charges that have to be paid, eligibility criteria, and the quality of customer service.

Why seek Loans Like NetCredit?

NetCredit serves different loan products, but this service provider may not always be the most fitting one. Here are some common reasons people seek alternatives:Here are some common reasons people seek alternatives:

- Interest Rates and Terms: As for the rates of interest, they can be higher compared with the rates from other similar companies, especially in the case of individuals with good credit histories.

- Loan Amounts and Terms: You might have the ability to get more each with other lenders wherein the given quantities as well as conditions are more accommodating.

- Customer Service: As for the key promises made by the primary stakeholders, some users received higher customer experiences with other lenders.

Top Alternatives to NetCredit

LendingClub

Overview:

LendingClub is a form of an online marketplace lending that matches buyers and sellers for loans to be issued. It gives out personal loans for different purposes, which include, but not limited to, pay off debts, and to facilitate home renovations.

Loan Products:

- Loans come in the form of personal loans which are provided from $1,000 to $40,000.

- Fixed APRs from 8. 05% to 35. 89%

- Interest rates and loan durations for 36 to 60 months

Eligibility Requirements:

- This policy requires borrowers to have a minimum of 600 and permits deferred payments at the discretion of the lender.

- They also come in handy when demonstrating descent income and employment history.

Pros:

- In the broad category of interest rates, only one sub-category was found that involved good credit borrowers and that had competitive rates.

- Quick approval process

- No prepayment penalties

Cons:

- This ranges from 1% to 6% for the origination fees that might be required of you when accessing credit facilities.

- If the borrower has a lower credit rating then the interest rates that are charged on the loan are even higher.

SoFi

Overview:

SoFi is a smooth financial company in today’s generation and among the many services they offer are personal loans. My grandparents used it for their member benefits and the best rates they could find.

Loan Products:

- It offers personal loans between $5000 and $100,000.

- Fixed APRs from 5. 99% to 22. 23%

- As for the loan maturity, it can range from 24 to 84 months

Eligibility Requirements:

- The interviewee should have at least a minimum credit score of 680.

- Proof of stable income

Pros:

- There will be no any charges including the origination fees, prepayment fees, or late fees charg

- Earnings protection and career guidance

- There exists a probability of high interest rates that vary depending on the credit score of the borrower.

Cons:

- Higher credit score requirement

- It involves longer approval periods than most of the other mortgage tied products.

Upstart

Overview:

Upstart is an online lender that minimally relies on human credit underwriting to evaluate loan applications, which makes it a different kind of actor in the personal loan market. It also takes into consideration parameters that are not domain to credit scores such as educational background and past employment records.

Loan Products:

- I was able to successfully apply for a personal loan of $1, 000 – $50,000.

- Fixed APRs from 6. 76% to 35. 99%

- Loan repayment periods ranging from 36 months to 60 months

Eligibility Requirements:

- Any score of 600 and above for the credit rating.

- Inclination towards education and work experience

Pros:

- More inclusive approval criteria

- Business day funding time may as well be referred to as fast funding, as in they will be able to find funding within one business day.

- No prepayment penalty

Cons:

- He now offers higher interest rates to the clients with low credit ratings.

- Innovation charges as high as 8%

Avant

Overview:

Avant specializes in personal loans, those having average to Poor Credit Score. It is suitable for individuals and Co-operatives who may not meet the standards of getting loans from other money lenders.

Loan Products:

- Fixed rate personal loans form $2,000 to $35,000

- Fixed APRs from 9. 95% to 35. 99%

- Loan terms ranging from 24 months to up to 60 months

Eligibility Requirements:

- Minimum credit score 140 Credit scores of 580 or more are needed in order to better have a chance of getting approved.

- Steady income and employment

Pros:

- Flexible credit requirements

- Their application process and time to fund the loans are quite fast.

- No prepayment penalties

Cons:

- The financial statistics of the company and their credit offerings also show that APRs of credit unions can be higher compared to other non-credit union lenders.

- Maximum up to 4 Euros is charge as Administration fee. 75%

Prosper

Overview:

Like Funding Circle, Prosper is another platform that deals with peer to peer lending and avails personal loans for different purpose. It offer borrowers directly with individual investors.

Loan Products:

- Among these, personal loans range from as little as $2,000 to as much as $40,000.

- Fixed APRs from 7. 95% to 35. 99%

- Loan terms ranging from 36, months to 60, months

Eligibility Requirements:

Since its inception, the company has maintained certain criteria of qualifying for an auto loan, and some of them include; Credit score of at least 640.

Debt-to-income ratio below 50%

Pros:

- Nicely rounded and competitive for good credit borrowers

- No prepayment penalties

- This means that loan terms and the associated requirements will be clear to the borrower, and they won’t be able to hide anything.

Cons:

- That originate fees of 2. 41% to 5%

- Some of the factors that most of these so-called ‘. Explained: Higher Interest typically accompany the smaller credit limits, lower credit scores.

Comparing the Alternatives

| Lender | Loan Amount | APR Range | Loan Terms | Min. Credit Score | Key Benefits |

|---|---|---|---|---|---|

| LendingClub | $1,000 – $40,000 | 8.05% – 35.89% | 36 – 60 months | 600 | Competitive rates, quick approval |

| SoFi | $5,000 – $100,000 | 5.99% – 22.23% | 24 – 84 months | 680 | No fees, member benefits |

| Upstart | $1,000 – $50,000 | 6.76% – 35.99% | 36 – 60 months | 600 | Inclusive approval criteria, fast funding |

| Avant | $2,000 – $35,000 | 9.95% – 35.99% | 24 – 60 months | 580 | Flexible credit requirements, fast approval |

| Prosper | $2,000 – $40,000 | 7.95% – 35.99% | 36 – 60 months | 640 | Competitive rates, transparent terms |

How to Choose the Right Personal Loan Provider

- Assess Your Needs: Define the amount of money that you will require for the loan and the purpose for which you will spend this amount. This will assist in making the decisions because they will be limited to a few choices.

- Check Your Credit Score: Having an idea on the credit score will assist one in determining the type of lenders that one can qualify and the rates that he or she is likely to be charged.

- Compare Rates and Terms: Check the APR, the loan terms, the whole fees that are connected to the loan, and more. Many online models are available to find out the total amount which one will pay for any given loan.

- Read Reviews: Begin by identifying their rating from the customers to feel how esteemed the lender is and how they treat customers.

- Pre-Qualify: Some of them allow pre-qualification, which takes you to the rates and terms of the loan that is provided without affecting your credit score.

- Understand the Fine Print: It goes without saying that you should read the loan agreement as well as all the additional documents that you might be asked to sign, for you to learn about all the terms and conditions like the fees which are charged.

Tips for Improving Your Chances of Approval:

Reduce your current credit balances and regularly make installments on an agreed payment plan so that you begin to enjoy a good credit score.

Lenders may also consider a co-signer if you have a poor credit score or no credit history at all.

Ensure that you give all the details necessary in the loan application to the lenders, and do it accurately.

Common Pitfalls to Avoid:

Diving in deeper than what one can do to repay the loan they seek

The essence of neglecting the special offers, small print and charges

Omission of the overall cost of borrowing again inclusive of the interest charged and other fees.

Additional Resources and Tools

- Financial Calculators: You can also use the numerous Internet tools like loan calculators to compare the offers received and calculate monthly payments.

- Credit Monitoring Services: Always keep a check on your score and report so that you can properly proceed for a loan.

- Financial Literacy Resources: There are websites, which can provide the necessary information and resources for individuals to learn more about the given personal loan and other similar financial products such as the Consumer Financial Protection Bureau.

- Financial Counseling Services: Many community-based organizations such as the National Foundation for Credit Counseling (NFCC) can help you in this process and to put your financial situation on positive track.

The decision on which personal loan provider to go for involves a lot of consideration if the reasoning behind it is to do it properly and for effectiveness. As much as NetCredit is tenable, there remains a potential in other options such as LendingClub, SoFi, Upstart, Avant, and Prosper that may present more preferable rates, services, and terms. Just like usual, do your own homework well and try to compare various possibilities and do not hesitate to turn to a financial specialist in order to get the best solution.

As has been seen today, an informed choice made today results in higher monetary returns in the future.